The National Stock Exchange (NSE) has recently introduced the Nifty India Tourism Index, a new benchmark designed to track the performance of the Indian travel and tourism industry. This index, comprising 30 stocks from the travel and tourism sector, is set to provide investors and industry stakeholders with valuable insights into the growth and development of this dynamic sector.

Exploring the Nifty India Tourism Index : Key Insights & Opportunities

The Importance of the Travel & Tourism Industry in India:

The travel and tourism industry plays a crucial role in India’s economy, contributing significantly to the country’s GDP and employment. According to the World Travel & Tourism Council (WTTC), the sector accounted for 6.8% of India’s GDP and supported 39.8 million jobs in 2019. The industry has been growing steadily over the years, driven by factors such as rising disposable incomes, increased air connectivity, and the government’s focus on promoting tourism.

The Need for a Dedicated Tourism Index:

Until now, there has been no dedicated index to track the performance of the Indian travel and tourism sector. The introduction of the Nifty India Tourism Index fills this gap, providing a benchmark for investors and industry participants to gauge the sector’s performance. The index will also serve as a reference point for policymakers and industry stakeholders to assess the impact of government initiatives and policies on the sector.

Composition of the Nifty India Tourism Index:

The index comprises 30 stocks from the travel and tourism sector, selected based on their market capitalization, liquidity, and sector representation. The constituent stocks are classified into three categories: airlines, hotels, and travel services. Some of the prominent companies in the index include InterGlobe Aviation (IndiGo), Indian Hotels Company (Taj Group), and Thomas Cook (India).

Methodology and Weightage:

The index is calculated using the free-float market capitalization method, which takes into account the number of shares available for trading in the market. The weightage of each stock in the index is determined by its market capitalization and the sector it belongs to. This ensures that the index reflects the performance of the entire travel and tourism sector, rather than being skewed towards a few large companies.

Benefits of this Index:

The introduction of the Nifty India Tourism Index brings several benefits to the travel and tourism sector, including:

- Increased Visibility: The index provides a platform for companies in the sector to showcase their performance and attract investments.

- Benchmarking: The index serves as a benchmark for investors to compare the performance of individual stocks and portfolios against the broader travel and tourism sector.

- Policy Impact Assessment: The index can be used to assess the impact of government initiatives and policies on the sector, helping policymakers make informed decisions.

- Investment Opportunities: The index can help investors identify potential investment opportunities in the travel and tourism sector.

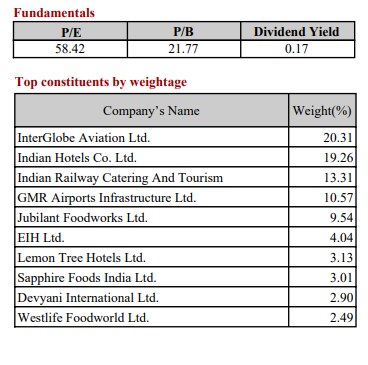

The high price-to-earnings (P/E) ratio of 58.42 for the index suggests that the stocks in the index are currently trading at a high valuation compared to their earnings. This could indicate that the market is expecting strong future growth in the sector, or it could mean that the stocks are overvalued and due for a correction.

The top holdings of the index would provide more insight into the companies driving the high P/E ratio. If the top holdings are mature, stable companies with strong earnings, the high P/E ratio could be justified. However, if the top holdings are smaller, high-growth companies that are still in the early stages of their growth, the high P/E ratio could be a sign of overvaluation.

Some people are optimistic about the growth potential of the Indian tourism sector, driven by factors such as rising disposable incomes, increasing consumer spending on travel, and the government’s focus on promoting tourism.

There are concerns about the valuation of the index and the high P/E ratio of the top holdings. This could indicate that the stocks are overvalued and due for a correction.

The launch of a Nifty India Tourism Index Fund by a fund house is seen as a positive development for investors looking to capitalize on the growth potential of the tourism industry in India.

There are also some negative opinions about the Indian tourism sector, with concerns about the lack of good tourism facilities and the need for more investment in the industry.

Conclusion:

The Nifty India Tourism Index is a significant development for the Indian travel and tourism industry. By providing a dedicated benchmark for the sector, the index is set to enhance the visibility and attractiveness of the industry, while also serving as a valuable tool for investors and policymakers. As the Indian travel and tourism sector continues to grow and evolve, the Nifty India Tourism Index will play a crucial role in tracking its progress and identifying opportunities for growth.